✓ To read SEBI Circular dated February 8, 2019 prescribing format on Annual Secretarial Compliance Report, please click here.

March 31, 2021

BSE Update: Filing of Annual Secretarial Compliance Report in XBRL Mode by Listed Companies

✓ Bombay Stock Exchanges (BSE) has mandated listed companies to file Annual Secretarial Compliance Report through XBRL Mode in addition to the filing in PDF mode within 60 days of end of financial year in accordance with SEBI Circular dates February 8, 2019.

March 25, 2021

SEBI Update: Ease of Listing of Start-up and Amendments in compliance requirements applicable to Listed Companies

SEBI has approved following amendments in its meeting held on March 25, 2021.

∆ Key relaxations for Start-up Company:

- Listing criteria of Start-up on Innovators Growth platform (IGP) under SEBI

(Issue of Capital and Disclosure Requirements) Regulations, 2018 has been relaxed as follows:

- Issuer to have 25% of pre-issue capital held by eligible investors for two years period, is reduced to one year.

- The term ‘Accredited Investor’ for the purpose of IGP is renamed as

‘Innovators Growth Platform Investors’.

- At present, pre-issue shareholding of such investors for meeting eligibility, is considered for only 10%, which is now increased and shall be considered for the entire 25% required for meeting eligibility norms.

- Issuer Company is not permitted to make discretionary allotment unde IGP framework, which is now decided to allow Issuer Company to allocate up to 60% of the issue size on a discretionary basis, prior to issue

opening, to eligible investors with a lock in of 30 days on such shares.

- In line with the provisions of Main Board IPO, Issuer companies which have issued Superior Voting Rights (SR) equity shares to promoters / founders

shall be allowed to do listing under IGP framework.

- For companies listed under IGP framework, stipulation for triggering open offer under Takeover Regulations, 2011, has been relaxed from existing 25% to 49%. However, irrespective of acquisition or holding of shares or voting

rights in a target company, any change in control directly or indirectly over target company will trigger open offer.

- Delisting under IGP framework shall be considered successful if the post offer acquirer/promoter shareholding, taken together with the shares tendered and accepted, reaches 75% of the total issued shares of that class; and at least

50% shares of the public shareholders are tendered and accepted.

- Further, for delisting under IGP framework, the Reverse Book Building mechanism shall not be applicable, and for computation of offer price, the

floor price will be determined in terms of SEBI (Takeover) Regulations, 2011, along with delisting premium as justified by the acquirer/promoter.

- Presently for a company not satisfying the conditions of profitability, net

assets, net worth, etc., migration from IGP to Main Board requires a company to have 75% of its capital held by QIBs as on date of application for migration. This requirement is now reduced to 50%.

∆ Key Relaxation/Amendments for already Listed Company (other than Start-up):

- Major relaxation/ amendments approved in SEBI (Listing Obligations and Disclosure Requirements Regulations, 2015) (Listing Regulations) as follows:

✓ Dividend Distribution Policy:

- Applicability of Dividend Distribution Policy enhanced to Top 1000 Listed Companies (based on market capitalisation as on 31st of March of financial year).

✓ Intimation of Financial Results in case of Adjourned Meeting:

- In case of board meetings held for more than one day, the financial results shall be disclosed by listed entities within 30 minutes of end of the board meeting for the day on which the financial results are considered.

✓ Applicability of Corporate Governance Norms:

- The provisions of the LODR Regulations which become applicable to listed entities based on (i) the market capitalisation criteria, shall continue to apply even if such entities subsequently fall below the specified thresholds (ii) paid-

up capital and net-worth, shall continue to apply to such entities unless the paid-up capital or net-worth falls and continues to remain below the threshold for a period of three consecutive financial years.

✓ Requirement to obtain Stock Exchange Approval for change of name has been removed.

✓ Harmonisation of Filing Timeline:

- The timelines for submission of periodic reports viz. statement of investor complaints, corporate governance report and shareholding pattern will be harmonized to 21 days from the end of each quarter.

- Frequency of submission of compliance certificates relating to share transfer facility and issuance of share certificates within 30 days of lodgement for transfer, sub-division, etc. is revised from half-year to annual.

✓ Publication of Board Meeting newspaper advertisement for consideration of financial results:

- The requirement to publish newspaper advertisements for the notice to board meetings where financial results are to be discussed and for quarterly

statement on deviation or variation in use of funds, is dispensed with.

✓ Risk Management Committee (RMC):

- From Financial Year 2021-22 onwards.

the requirement to constitute the RMC is applicable to the top 1000

listed entities by market capitalization from the existing top 500 listed entities.

- The RMC shall have minimum three members with majority of them being

members of the board of directors, including at least one independent director.

- The quorum for a meeting of the RMC shall be either two members or one

third of the members of the committee, whichever is higher, including at least

one member of the board of directors in attendance.

✓ Approval to rationalize the existing framework pertaining to reclassification of promoter / promoter group entities which includes certain exemptions and reduction in time period between Board and Shareholders meeting for consideration of reclassification request.

✓ Business Responsibility Report:

- Business Responsibility Report (BRR) replaced with Business Responsibility Sustainability Reporting (BRSR) filed by the listed companies. And it's applicability extended to top 1000 listed entities (by market capitalization), for reporting on a voluntary basis for Financial Year 2021 – 22 and on a mandatory basis from Financial Year 2022 – 23.

✓ Analyst/Institutional Investors Meet:

- Amendments in filing timelines for disclosures in respect of analyst/ institutional investor meets by the listed entity

∆ Key Relaxation/Amendments in other SEBI Regulations:

1. SEBI (Delisting of Equity Shares) Regulations, 2009 and SEBI (Portfolio Managers) Regulations, 2020 amended.

2. Approval for intermediaries to pay fees only through online payment gateway and doing away with physical mode of payment

Company Law Update: Amendments in Accounting and Audit Report related norms

Latest update on Amendments relating to Accounting under the Companies Act, 2013:

∆ Following amendments w.r.t. Audit Trail in Accounting Software and its reporting in Audit Report, deferred to 01-April-2022

1. Companies (Audit and Auditors) Second Amendment Rules, 2021

2. Company (Accounts) (Second Amendment Rules), 2021

Amendments relating to Accounting under the Companies Act, 2013:

1. Companies (Accounts) Amendments Rules, 2021

✓ Mandatory use of Accounting Software having Audit Trail:

- From Financial Year 2021-22 onwards, every Company shall use Accounting Software having features to record the audit trail of each transaction, creating the edit log of changes made & ensuring that the audit trail cannot be disabled.

2. Companies (Audit and Auditors) Amendments Rules, 2021

✓ Other Statutory Disclosures to be Included in Auditors Report:

A. Reporting regarding advances, loans & Investment other than disclosed in notes to accounts.

B. Receiving of funds for further lending or investing other than disclosed in notes to accounts.

C. Dividend declared or paid is in compliance of Section 123 of Companies Act, 2013.

D. Comment of use of Accounting Software having Audit Trail & other rules therein.

3. Amendments in Schedule III of Companies Act, 2013

✓ Introduction of certain new disclosure has been mandatory to be included in Auditor's Report as follows:

A. Disclosure of Shareholding of Promoters

B. Trade Payables ageing schedule with ageing

C. Reconciliation of the amounts of each class of assets

D. Trade Receivables with ageing schedule

E. Detailed disclosure regarding title deeds of Immovable Property not held in name of the Company.

F. Disclosure regarding revaluation & CWIP ageing.

G. Loans or Advances granted to promoters, directors, KMPs and the related parties

H. Details of Benami Property held

I. Reconciliation and reasons of material discrepancies, in quarterly statements submitted to bank and books of accounts.

J. Disclosure where a company is a declared wilful defaulter by any bank or financial Institution.

K. Relationship with Struck off Companies.

L. Pending registration of charges or satisfaction of Charges.

M. Compliance with number of layers of companies.

N. Disclosure of certain Ratios.

O. Compliance with approved Scheme(s) of Arrangements.

P. Utilisation of Borrowed funds and share premium.

Q. Details of transaction not recorded in the books that has been surrendered or disclosed as income in the tax assessments.

R. Disclosure regarding Corporate Social Responsibility.

S. Details of Crypto Currency or Virtual Currency.

Commencement of all above Amendments: April 1, 2021

March 19, 2021

Company Law Updates: Remuneration to Independent Director and Filling of forms under Company Law

✓ Provisions of Remuneration to Independent Director:

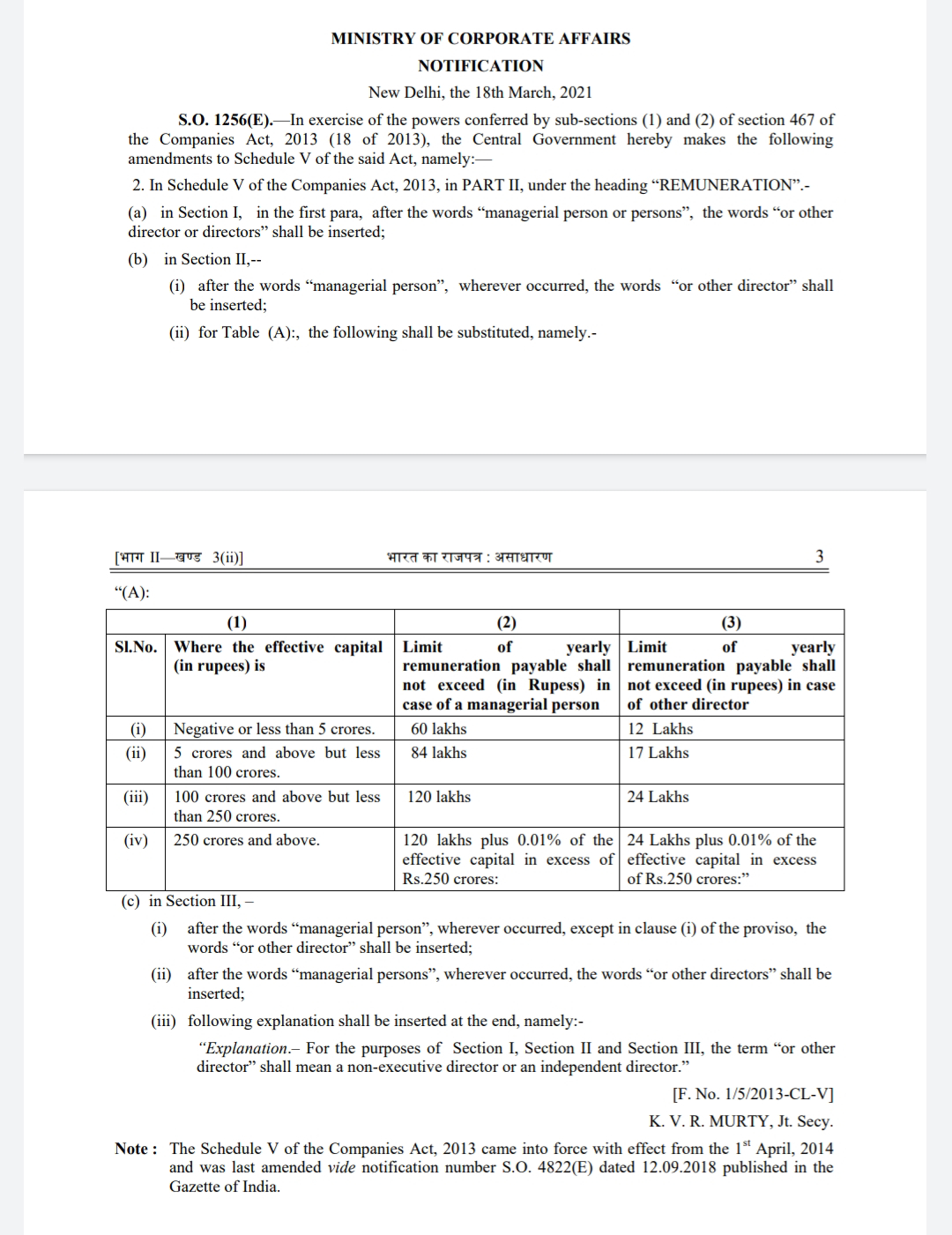

√ Central Govt. notifies much awaited amendment proposed in CAA, 2020 with respect to payment of remuneration to NEDs & IDs in case of inadequacy or no profit (section 32 & 40 of CAA, 2020) with effect from March 18, 2021.

√ Vide amendment notification dated March 18, 2021, Schedule V of the CA, 2013 is amended to include NEDs & IDs within Part II of Schedule V and thereby enabling the payment of remuneration to NEDs & IDs by companies having inadequate or no profit (in addition to sitting fees).

✓ Filing of Forms under Company Law:

Establishment of Central Scrutiny Centre (CSC) to carry out Straight Through Processes (STP) of forms filled under Company Law.

March 15, 2021

Important Update: CS/CA/CWA equivalent to be Post Graduate Degree for appearing UGC Net.

✓ University Grant Commission (UGC) has pleased to recognise the CS/CA/CWA Qualification equivalent to Post Graduation Degree for appearing in UGC net.

✓ Big milestone in the history of professional qualification and will open a plethora of opportunities for fellow professionals.

March 10, 2021

Foreign Trade Policy: Import Export Code ("IEC")

✓ For the first time, filing of details relating to Import Export Code (IEC), is mandated.

✓ Among others key amendment is, as per new rules details of Import Export Code (IEC) mandatorily to be updated every year electronically during April-June quarter.

✓ Confirmation to be filed every year mandatorily even in case of no change in the details.

Subscribe to:

Comments (Atom)

Featured Post

Read Interesting & Important News Everyday

Read Interesting & Important News Everyday 1. This IIT graduate left his high-paying job to build a business 2. Money Matters: 6 Appli...

-

*Business Standard :* 📝 MoD signs ₹5,083 crore helicopter, missile deals with HAL and Russia 📝 IFSCA cuts retail fund fees by 33%; India I...

-

∆ e-Form CSR 2 will be filed separately for FY 22-23 by the Companies. @ Due date for filing without any penalty shall be March 31, 2024. ...